BASE Foundation is releasing a comprehensive white paper unveiling unique knowledge and insights on the Energy Savings Insurance (ESI). ESI is an innovative business model developed in the framework of a collaboration between BASE and the Inter-American Development Bank (IDB) in 2015 to sensibly reduce the perceived risks associated with acquiring energy-efficient equipment. Recognising the pivotal role of small and medium enterprises (SMEs) in decarbonising the economy, but also the barriers they face when it comes to investing in energy efficiency upgrades, the concept of a model that would guarantee the energy savings of efficient systems with enhanced safety arose.

After a successful implementation in Latin America demonstrating the potential of the mechanism to facilitate the adoption of more sustainable energy solutions by different businesses, the Energy Savings Insurance has been carried out in other countries around the world under the leadership of BASE. Nine years on, whilst the core concept of ESI has remained, various deployments and adaptations to new markets made the model like the baton of a global relay, each hand contributing to shaping it for better effectiveness and broader adoption. BASE and its ESI team are now proud to share the knowledge aggregated throughout the years and diverse experiences in the format of a unique white paper comprising the latest information and learnings stemming from the model’s implementation.

Business models to support the decarbonisation of our economies

Whilst energy efficiency is considered the most cost-effective way to achieve the energy transition, the higher price of high-performance energy technologies and uncertainties on their financial and environmental returns often dissuade potential uptakers. Small and medium enterprises, which constitute the backbone of the world’s economies as they represent 90 percent of businesses on the planet, tend to prioritise investments in their core activities rather than upgrading energy systems perceived as a more uncertain investment. Therefore, addressing the performance risk of cleaner energy solutions is essential to further enhance their benefits, which primarily include energy consumption reductions, and consequently lowered utility and operating expenses, reduced CO2 emissions and improved sustainability.

Energy services companies (ESCOs) have been striving over the past decades to achieve the necessary risk mitigation through innovative business models, leading to the development of shared savings and guaranteed savings energy performance contracts (EPCs). The former shifts the performance risk from the client to the provider and the latter reduces it by enabling a coverage of the savings in case of insufficient efficiency. However, conflicts of interest regarding the generation of savings and an unbalanced distribution of risks between the two parties constitute two obstacles to the wider use of the models. Based on this observation, the Energy Savings Insurance was designed to alleviate the responsibilities of both stakeholders and reinforce trust in their relationship. It does so by adding a validation firm to independently verify the equipment’s performance and an insurance product to reimburse any difference between contractually determined energy savings and actual results.

The Energy Savings Insurance: a win-win solution to bring energy efficiency and peace of mind together

The Energy Savings Insurance originated when realising the main obstacles that prevented the adoption of energy efficiency in Latin America were the lack of trust in the actual energy savings that different technologies described as ‘efficient’ could provide, and the prioritisation of short-term profitability. As a result, BASE and the IDB with the support of the Danish government, conceptualised the ESI model, and the Colombian development bank Bancoldex launched the first programme bringing it to market. After seven years, in Colombia alone, 262 projects benefited from ESI, representing a total of over USD 28 million of investments.

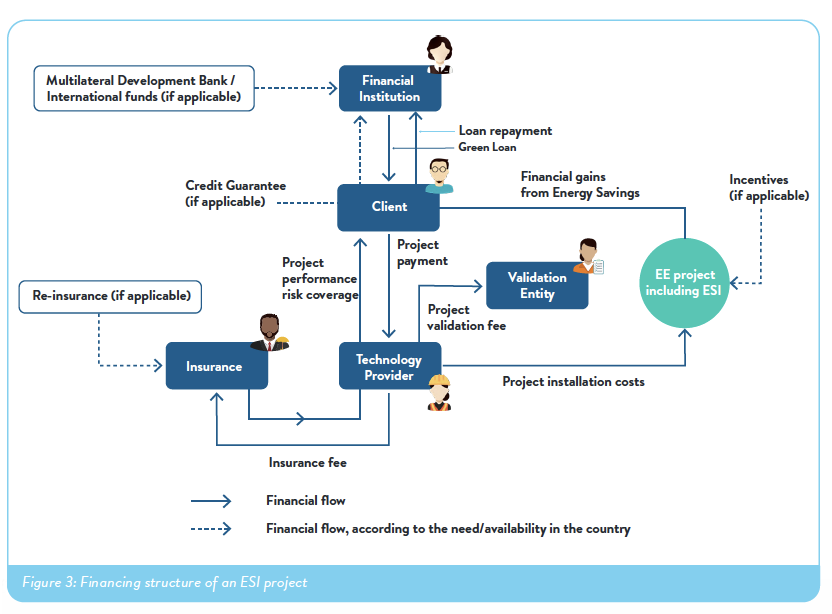

The achieved success and expected potential of ESI stems from the unique combination of five components which together bring unmatched safety and transparency to all stakeholders involved. At the heart of the model, lies the insurance on energy savings, which gives its name to the model: via this insurance, usually a surety product, ESI is able to provide an unparalleled guarantee on the energy savings the newly installed energy system aims to deliver. Other elements include 1) a standardised contract, offering a transparent and simplified framework for technology providers and their clients, 2) a technical validation conducted by an independent entity to measure and certify the performance of the efficient equipment installed, 3) an affordable financing solution such as green loans, and 4) an online platform to track energy savings and facilitate information exchange.

How does it work?

At the onset of an energy efficiency project involving the ESI model, the provider of the high-performance system commits to a certain amount of energy consumption reduction its product should bring to the client This committed energy saving is checked and validated by a technical independent body and is backed up by an insurance company through the energy savings insurance. This way, ESI enables businesses to acquire more sustainable energy solutions with the certainty that their energy costs will decrease for a given level of comfort. Insuring the equipments’ performance also allows for enhanced access to financing for cleaner technologies as it can reduce overall operation expenses and therefore lower the chances of repayment default from the client.

By combining these risk mitigation measures with the complementary elements, the ESI model can effectively facilitate financing, ensure performance accountability, and drive the adoption of energy-efficient technologies.

What the rollouts of ESI models taught us:

Additionally to the above-described rollout of the model in Colombia, the adoption of ESI saw a constant growth in other countries of Latin America, including Argentina, Brazil, Chile, Mexico, Paraguay, Peru, Nicaragua and El Salvador. In the latter alone, 84 projects using the model were conducted as of March 2023. The effective introduction of ESI in several countries constitutes a testament to its replicability, which initiatives to bring it to other parts of the world underline.

Interestingly, different markets framed by diverse contexts highlighted the need to tweak or adapt certain components of the ESI model to better overcome local challenges or tailor the model to specific needs. For instance, it occurred that surety products, which are the most convenient insurance offer for ESI, are not always available in certain countries. During the ESI Morocco project, while the relevant legislation for this type of product existed, no surety provider could be identified by the implementing team. To address this type of difficulty, bank guarantees or brokers offering the product from abroad can be leveraged to enable the provision of the model. In some cases, it has even proved possible to develop a tailored product. In Mongolia, the insurance company Tenger worked with the local administration and regulator to create an insurance offering, differing from surety products in the strict legal sense, but featuring the necessary elements to provide the ESI guarantee. As another example, in Mexico, a hedging instrument was granted to clients to act as a performance warranty for the committed savings throughout the contract duration.

The introduction of the model has also been carried out in various manners. BASE has often served as a lead facilitator for deploying the model, striving to engage local stakeholders, such as banks, insurance companies, validation firms, and most importantly providers of energy-efficient products and businesses around a common project. BASE has partnered with different local entities to drive the ESI programmes. In Latin America, the Inter-American Development Bank supported most of these endeavours, while national development banks led the initiatives, such as Bancoldex in Colombia and BANDESAL in El Salvador. But private commercial banks also demonstrated keen interest and ability to develop such programmes. In Mongolia, XacBank, pioneering ‘eco-banking’ in the region, chose to use ESI in combination with concessional green loans to enable existing and potential customers to invest in energy efficiency, leading the development with the above-mentioned Tenger Insurance, part of the same group. BASE partnered often with NGOs, such as the Društvo za oblikovanje održivog razvoja (DOOR) to advance the deployment of ESI in Croatia. The ESI Europe 2.0 programme, led by BASE with support from the European Commission to bring the model to Croatia, Greece and Slovakia, further demonstrates the flexibility of the model, as national agencies promoting sustainable energy also joined the implementing consortium with their wealth of experience and resources stemming from their deeply-rooted presence in the local energy sector.

Crucial learnings from the rollout of ESI over the past decade also have been acquired regarding criteria technology providers may have to respond to be eligible for insurance coverage, the integration of a clear financing strategy to support SMEs’ ability to invest, ways of promoting the model locally and communicate its benefits, as well as strategies to engage first movers for pilot projects. These valuable lessons have been meticulously compiled in the Energy Savings Insurance White Paper.

Explore the unique benefits of ESI to accelerate the energy transition in BASE’s latest white paper

Developed by BASE specialists with long-standing experience with the model, the white paper now serves as a comprehensive resource, capturing all aspects of the ESI model. It provides in-depth analysis, case studies, and best practices that have emerged from the application of the model in diverse contexts. The document offers a deeper understanding of the model’s effectiveness, adaptability, and the specific strategies employed to overcome challenges in each location.

By sharing these learnings in a consolidated white paper, BASE Foundation aims to contribute to the knowledge surrounding energy efficiency risk mitigation and financing, and inspire further innovation and replication of successful practices. The collective wisdom and insights gained from diverse experiences will inform and empower stakeholders, policymakers, financial institutions, and other entities interested in implementing similar models globally. Access the white paper here.